Land rolls available for viewing at Lincoln County Chancery Clerk Office

Published 3:00 pm Tuesday, August 5, 2025

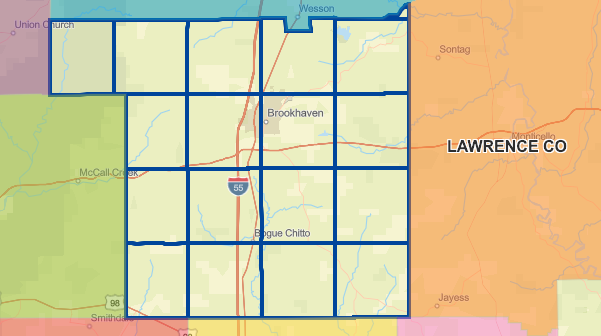

- https://lincolncoms.maps.arcgis.com/

Though taxpayers can expect to see an increase in the appraised value of their property, Lincoln County Tax Assessor Blake Pickering cautions this does not necessarily mean a tax increase will follow.

“That is dependent on the millage rate, and if the millage rate is lowered then it will offset most of the increase in value,” he said. “Upon speaking with the (Lincoln County) Supervisors and the (Brookhaven) Aldermen, I have every confidence that they will continue to set the millage rate at a level that will not further burden the taxpayers of our county. They have always done a good job being good stewards of the public’s money and I see no reason that trend will not continue.”

Because Lincoln County faced mandated appraisals this year, Pickering requested and received a 30-day extension to complete the land rolls. They are now available for public inspection in the records room of the Chancery Clerk’s office downstairs in the Brookhaven/Lincoln County Government Complex.

Trending

Any appeals to the rolls will be heard at the first meeting of the Board of Supervisors in September, if they cannot be resolved in Pickering’s office. At the second meeting in September, after hearing all of the appeals and issuing any necessary decisions, the Board of Supervisors will finalize the roll.

Pickering said an extension is a common practice during county reappraisal years.

“Reappraisal is a state-mandated process that every county goes through every four years. We adopt the new Department of Revenue appraisal manual and calculate the new appraisal index. This creates additional work when compared to a normal tax year,” he said. “By applying for an extension on the submission of the land roll it ensures adequate time for completion and review before the tax rolls are made available for public inspection.”

The Lincoln County tax rolls include both real and personal property. Real property is land and improvements such as buildings, pools, etc., he said. Personal is related to business taxes and includes furniture, machinery, and inventory needed for the operation of the business.

Pickering expects to hear complaints from some taxpayers who have inherited land or have rental property.

“One thing we see catch people off guard a lot is the tax bill on secondary property,” he said. “Without homestead, the bill on a home is significantly higher on those houses even though the appraised value of them doesn’t change at all. There is very little I can do about this unless there is an issue with the appraisal being incorrect.”

Trending

Pickering said he is available to speak to anyone who has questions about information found on the land roll.

“I do understand that taxes feel high. We do our best to make sure that property is valued fairly so that no one is paying more than their share,” he said. “I will say that most people are understanding that taxes have to be paid to provide us with the services that we all depend on like roads, bridges, law enforcement and school, and don’t usually complain too much. With that said, if you feel like your property value is too high, come see me and I will look over your appraisal with you.”