Lodging tax wins supervisors’ OK; goes to legislature

Published 6:00 am Tuesday, January 2, 2001

.

A 2 percent lodging tax sought by the chamber of commerce forretiree and tourism development efforts cleared another hurdleFriday with unanimous support from the Lincoln County Board ofSupervisors.

A 2 percent lodging tax sought by the chamber of commerce forretiree and tourism development efforts cleared another hurdleFriday with unanimous support from the Lincoln County Board ofSupervisors.

The Brookhaven Board of Aldermen approved the tax on Dec. 19.However, with one hotel in the county, aldermen made their supportcontingent on supervisors passing a resolution seeking the tax.

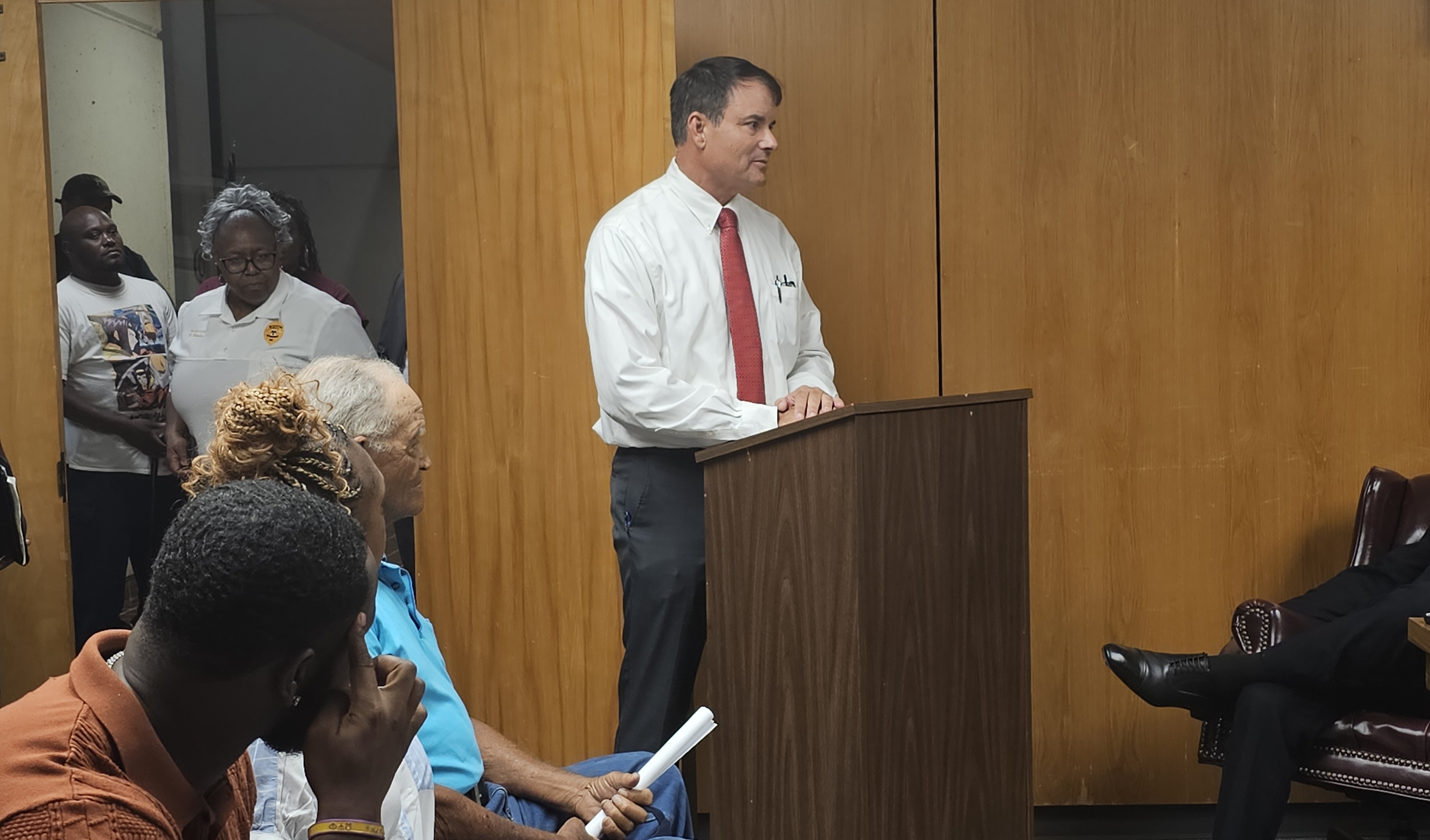

“In order to make sure everybody is on a level playing field,from a motel perspective, we need your approval to make thiscountywide,” Chandler Russ, chamber executive vice-president, toldthe supervisors.

With the county board’s OK, Russ said he can present theresolution to Dist. 92 Rep. Dr. Jim Barnett and Dist. 39 Sen. CindyHyde-Smith for them to request local and private state legislationto allow the tax. The 2001 legislative session begins Tuesday.

“They’ll get the actual legislation drafted,” Russ said.

Based on 1999 totals, the lodging tax would generate about$61,000 a year, Russ said. The money would fund increased marketingand other efforts for tourism and retiree development.

“We feel like we can get what we want accomplished . . . and nottax your local citizens,” Russ said.

Russ said the tax legislation would have a five-year “sunset”clause. At the end of the five years, the tax could be repealed ifit is not paying dividends.

“If we haven’t done anything with those dollars, let’s do awaywith it,” Russ said.

Supervisors, at times Friday, sounded skeptical about the taxplan.

Echoing concerns of some local hotel and motel officials, noneof whom were present at the meeting, District 1 Supervisor CliffGivens questioned the possibility of the tax sending peopleelsewhere.

“I just don’t see, logistically, how it could,” Russresponded.

Russ said the tax would amount to 70 cents a night on a $35 roomand $1 a night on a $50 room. For most travelers, he said that is a”non-event.”

Another hotel association contention is that Brookhaven lackstourist attractions and therefore promotion of the city as atourist destination. Russ said he disagreed with the association’sassertion.

“We think there are some positive things out there and we wantto increase public awareness of those,” Russ said.

In addition to such things as the Ole Brook Festival, Tour ofHomes, the arts school and sports complex, Russ said the idea is topromote Brookhaven as a central point for people to stay. FromBrookhaven, he said people could go to several area state parks,golf courses, a recreational lake under construction in Meadvilleand other places.

Russ cited economic benefits of having retirees move to a city,and he said the tax would be good in helping to attract them.Current retiree development efforts have yielded a $20 millionimpact on the local economy, and it could double with increasedtax-funded efforts.

“Looking at it from that standpoint, it’s still a good businessdecision,” Russ said.

District 3 Supervisor Nolan Earl Williamson expressed concernsabout whether visitors brought in from tax efforts would exceedlocal hotels’ capacity. He mentioned concerns raised previouslyabout the possibility of hotels not being able to accommodate artsschool students’ parents.

“I think supply will surely keep up with demand,” Russ said.

If chamber efforts are successful, Russ said local hotels shouldsee an increase in traffic.

“I think that’s going to be the biggest judge of that,” Russsaid.

District 4 Supervisor W.D. “Doug” Moak said McComb has triedseveral times to get a lodging tax approved but has always hadtrouble getting legislative approval.

“I feel like they’ll get it one day, they just have to bepersistent,” Moak said.

On a motion from District 2 Supervisor Bobby J. Watts, Watts andMoak initially voted for the tax. Williamson said he would like tohear from local hotels, but he and Givens voted to support the taxa few seconds later.

District 5 Supervisor Gary Walker made the vote unanimous afterhe received assurances the county hotel would see some benefitsfrom the tax. Like those in the city, Russ said the county hotelwould be included in local marketing efforts.

“If he gets something out of it, I don’t have any problems,”Walker said.

NEW ORDINANCES

In other action Friday, board attorney Bob Allen updatedsupervisors on some ordinances under consideration for thecounty.

A county right-of-way ordinance would establish a permit systemfor utility companies doing work on county roads, and a heavyhauling ordinance amendment would clarify county policy regardinguse of county roads. Both ordinances are expected to be discussedat Tuesday’s meeting.

Allen also reported progress on an interlocal agreement betweenthe city and county on operation of the Multi-Use Facility. Theattorney said he has received verbal approval from the AttorneyGeneral’s Office on most of the agreement but is awaiting writtenapproval on it and some changes that had to be made.

Changes include specifying that the city board of aldermen andcounty board of supervisors will each have one vote in decisionmaking and any disagreement would be arbitrated in chancery court.Also, whoever is chosen to oversee day-to-day operations must be anemployee of either the city or county, Allen said.

Allen hoped to have the agreement ready for final approval assoon as possible.

Also Friday, supervisors noted State Tax Commission approval ofthe county’s land value records. According to totals, the county’sreal property valuation is $82,962,656 and its personal propertyvaluation is $67,684,841.