Banks, authorities tracking credit card scheme

Published 6:00 am Monday, November 26, 2007

Local consumers remain concerned as credit cards and debit cardscontinue to be compromised by what appears to be a fraud schemethat has affected possibly hundreds of people in the Brookhavenarea, bank and law enforcement officials said.

Many Brookhaven area residents have been shocked to recievecalls from their bank or credit card company advising their cardnumbers have been compromised and were being used in places such asFlorida or Las Vegas. Luckily for consumers, most area banks reportlittle to no loss for their customers as the scam was detectedquickly and customers were notified.

One thing that has stymied authorities is the fact that incertain cases, credit card numbers are being used out of state whenthe owner still has the credit card in his or her possessionhere.

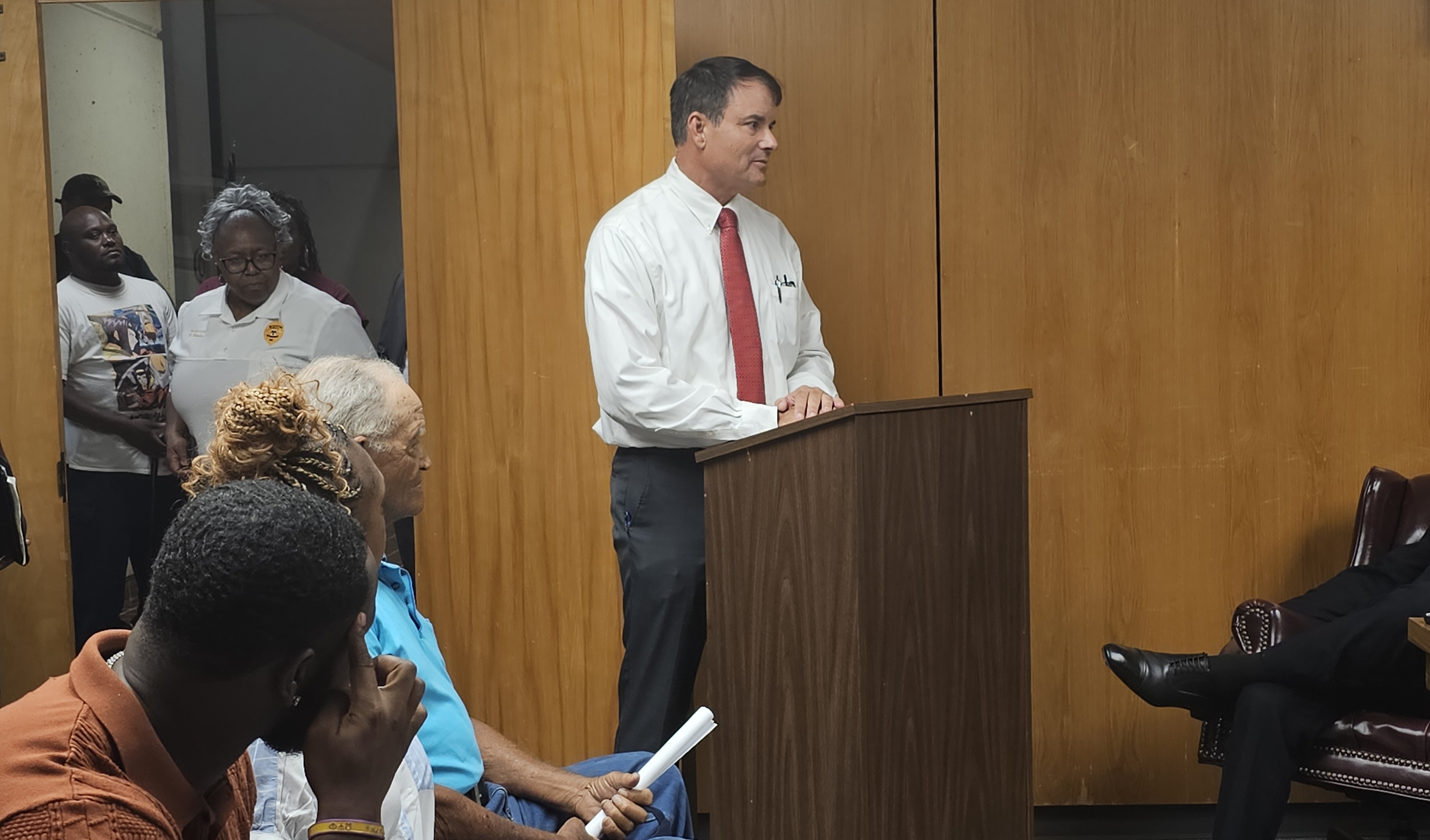

“It’s mystifying how it happens when you’re holding the creditcard in your hand and it’s being used somewhere else,” said PoliceChief Pap Henderson, who said federal authorities will be coming totown to try to pinpoint exactly how the scam is beingconducted.

He confirmed the Secret Service will be in Brookhaven in thenear future, and that he looks forward to collaborating with themand the banks to put a stop to the crime.

“We’ll all need to work together,” said Henderson, who urgedresidents to continue to report suspicious card activity to hisdepartment. “I’m happy for the feds to handle this, but mydepartment needs to be aware of what’s going on because there willbe people who will be more comfortable talking to us.”

Jason Freyou, executive vice president and chief informationofficer of State Bank and Trust, said consumers can prevent losingmoney to the scam by monitoring their bank accounts throughstatements or Internet banking.

“You’ve got to look for activity and transactions that don’tmake sense,” he said. “Watching your activity on the Internet andthrough your statement is the best way to handle it.”

Henderson said not only do the banks emphasize the importance ofconsumers monitoring their bank accounts, but he considers itintegral to catching the criminals as well.

“You need to check and see if you have an account that’s beentampered with, and I stress that highly,” he said. “In addition, ifit happens, please report it, because information you have couldhelp us in the investigation.”

Freyou said State Bank has a fraud management plan for itscustomers that computerizes their spending patterns and notes anydiscrepancies.

“What happens is the companies we use look for patterns inspending. If there is a similar dollar amount posting to a bunch ofcustomers at a certain bank, they go look at it,” he said.

Coney Lea, president of First Bank, said his bank also has asimilar system for catching fraud, as do most banks.

“We have a system in place called ‘Jack Henry’ that detectsfraud or any suspicious activity that comes through the account,”Lea said.

And such programs have helped protect the accounts of manypeople in the Brookhaven area, said Freyou.

“What we’ll do is we’ll warm or hot card the card so the crookscan’t use it and we’ll notify the customer,” he said. “We had acouple hundred customers that it affected and little or nolosses.”

Freyou said there are sophisticated criminals and even networksthat concentrate on credit card fraud alone, and that scams likethese actually occur every day throughout the nation.

“Sometimes people are not street smart enough and don’t realizehow sneaky and persuasive (the criminals) can be,” Freyou said.”It’s a very organized effort on the part of the bad guys and acase of naivete on the parts of customers who don’t check theirstatements and aren’t careful.”

Bank of Brookhaven Vice President Shannon Aker said he is gladtechnology at his bank and the others is such that scams like theone going on currently can be quickly detected.

“Identity theft is a problem, and this is a related item,” hesaid. “It’s unfair that thieves can take advantage of a conveniencelike credit or debit cards.”

And whether or not this situation could have been nipped in thebud is unclear, though bank officials said it’s hard to know how toprevent such occurrences.

“I don’t know that this could have been avoided in thisparticular case,” said Lea, saying that consumers must not just bevigilant now, but always.

Aker agreed, saying that shoppers shouldn’t give away theirphone number even to cashiers when shopping, as some major retailchains ask for at checkout.

“That’s just more information that could get breached, and theless information you can give the better,” he said. “Be proactive,be on the lookout, and be careful who you give info to.”

Also be prudent with information callers request over the phone,Aker said.

“If someone calls you and says they’re your bank or credit cardcompany and they’re asking for your social security number orcredit card number, don’t give it out,” he said. “Your bank alreadyknows all that.”

Consumers can rest easy knowing the banks are looking out forthem, Freyou said, but must be proactive in watching for problemswith their statement as well.

“I’d appreciate them knowing the banks are doing all we can toprotect their data, and we’re very concerned,” he said. “We spend alot of money to try to catch it before it happens, but we need theconsumers to do their part too.”

Aker stressed to customers that communication with their bank isimperative.

“If anyone thinks they may have been compromised or even has aquestion, they should call their bank and their bank can take careof it,” he said. “No question is dumb, and we’re glad to help withidentity theft and find ways to prevent it, especially witheveryone shopping during the holidays.”