Expert, supervisors discuss ‘American Rescue Plan Act’ spending options

Published 12:51 pm Thursday, February 24, 2022

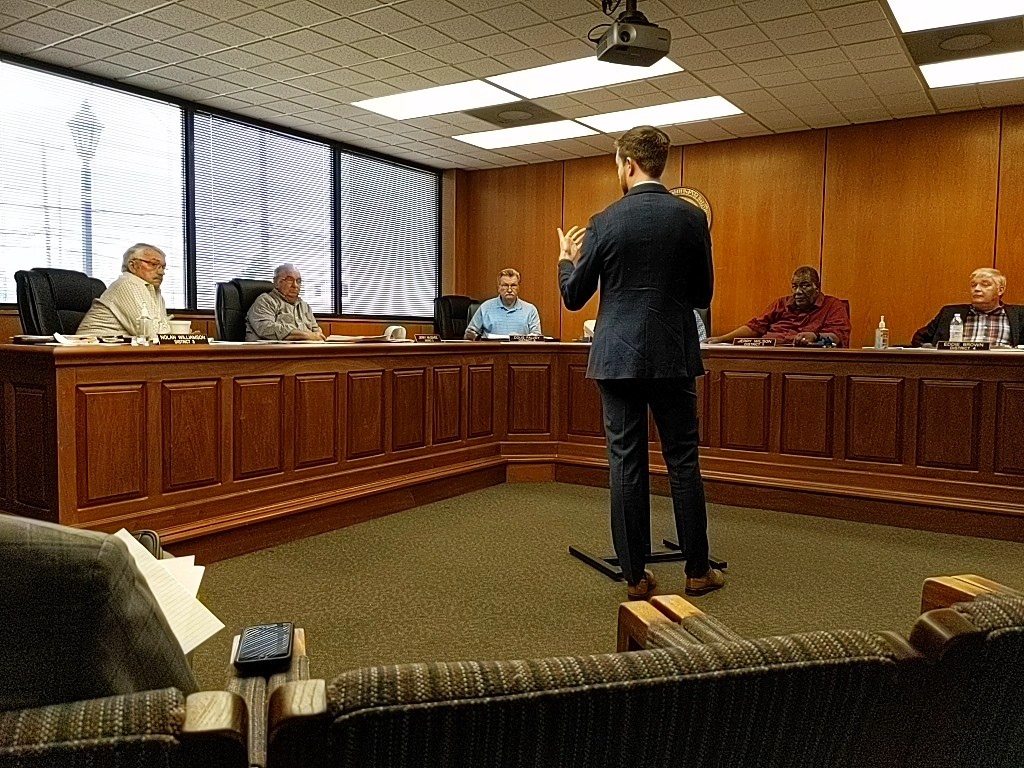

- Consultant Parker Berry of Butler Snow explains the ARPA’s intricacies to Lincoln County supervisors Feb. 22. Photo by Angela Cutrer.

Last summer, Lincoln County received half of the designated funds from the American Rescue Plan Act of 2021, and officials expect the rest to be deposited soon. But what to do afterward is still a question supervisors ponder.

That was the atmosphere Tuesday during the Lincoln County supervisors’ meeting: The county may be looking at a financial windfall, but where should the funds go?

Roads? First responders? Building renovations?

What good questions.

Parker Berry, a consultant with Butler Snow, spoke Tuesday to supervisors about the spending options, requirements, rules and regulations of the ARPA .

In March 2021, Congress passed the ARPA as a $1.9 trillion economic stimulus bill. ARPA then spawned the Coronavirus State and Local Fiscal Recovery Fund that designated $350 billion for states, municipalities, counties, tribes and territories throughout the country, including $130 billion for local governments, to be spent evenly between counties and municipalities.

Mississippi alone will receive more than $1.8 billion and its 82 counties and approximately 300 municipalities will split more than $500 million based on certain pro rata (proportional) formulas.

Lincoln County is looking at $3.3 million, which will be added to the $3.3 million it already received last summer. That money has been stewing untouched in an interest-bearing account ever since.

County Attorney Will Allen said there is a reason the money has remained untouched. “That’s why we have [consultants] coming to talk to us,” Allen told District 1’s Jerry Wilson, who had said the money needs to be spent before “we lose it.”

ARPA allows fund money to be used to pay for legal consultants and administrators, which is where Butler Snow came in. Perry attended the meeting to discuss how his company could help supervisors navigate the confusing and often times stringent formulas necessary for proper spending of the funds.

The monies under the fund must be obligated by the end of 2024 and spent by the end of 2026 under four main categories:

- responding to the public health pandemic of COVID-19 and its related negative economic impacts

- premium pay for essential workers

- government revenue losses

- investments in water, sewer and broadband infrastructure, or all three

“Most counties will use the funds for loss revenue,” Berry said. “[However, like anything else], you have to record everything – documentation is key.”

Last fall, the Department of the Treasury created a concluding “final rule” that said a standard presentation up to $10 million could be spent on “loss revenues.” That means entities could then spend the money on things they would have spent them on had revenue not been loss due to COVID-19 interference.

The “final rule” from the Department of Treasury is an aspect of the act that comes about after input from the public to the “initial final rule.” This – final – final rule then “delivers broader flexibility and greater simplicity in the program, responsive to feedback in the comment process:

Among its clarifications and changes are the following:

- Replacing Lost Public Sector Revenue, which offers a standard allowance for revenue loss of up to $10 million, allowing recipients to select between a standard amount of revenue loss or complete a full revenue loss calculation.

- Public Health and Economic Impacts, whichclarifies that recipients can use funds for capital expenditures that support eligible COVID-19 public health or economic response, such as building certain affordable housing, childcare facilities, schools, hospitals, and other projects consistent with final rule requirements.

- Significantly broadening eligible broadband infrastructure investments to address challenges with access, affordability and reliability.

Berry reported that his company doesn’t take a percent of the award, as other companies might. “We work hourly; you use us as much or as little as you like,” he said.

At one point, District 1 supervisor Jerry Wilson said, “If we sit on this money, we are going to lose it,” to which County Attorney Will Allen answered “that’s why Parker came to talk to us – so we would know the rules of how to spend the money before we spend it.”

Wilson asked why a different company that had planned to come present to the board hadn’t done so yet. Other supervisors said no other entity had come forth to be put on the agenda, but in order to spend the funds properly, the board needed to act one way or another in regard to hiring a consultant or not.

Berry said Butler Snow could help with determining eligibility, report assistance, contract and resolution drafting, program creation and administration for subreceipients and compliance documents with guidance.

Supervisors plan to vote on approving the hiring of a consultant this week.