Mississippi leaders spar over tax cuts as deadlines approach

Published 8:19 am Thursday, March 24, 2022

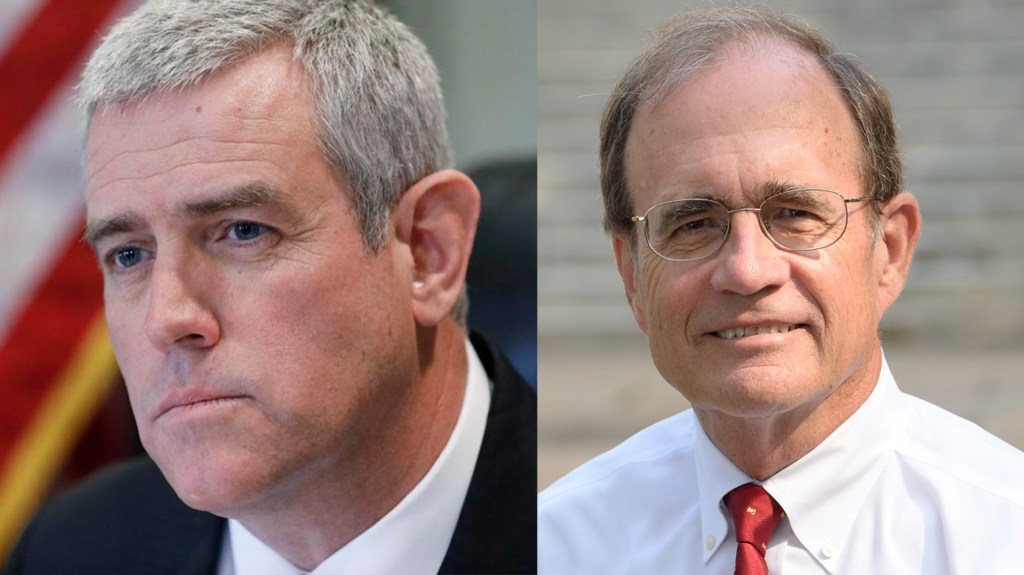

- Mississippi Speaker of the House Philip Gunn and Lt. Gov. Delbert Hosemann

(AP) — Mississippi House leaders offered a revised proposal Wednesday to phase out the state income tax, sending it to Senate leaders as legislators approach big deadlines to set taxes and spending.

The new House plan would make the income tax disappear over about 18-20 years, a substantially longer timeline than previously proposed. And the plan no longer includes a proposal to reduce the 7% sales tax on groceries.

Republican House Speaker Philip Gunn said the latest proposal would remove about $100 million in state tax revenue per year until the income tax is gone. He said a taxpayer earning $40,000 a year would receive a tax break of about $100 a month — enough to buy more gasoline or groceries.

“If we don’t give it back to the taxpayers, what then does the Senate propose that we do with it? I will tell you: They propose that we spend it,” Gunn said. “We contend that that money ought to be returned to the taxpayers.”

Republican Lt. Gov. Delbert Hosemann proposes reducing the income tax, reducing the sales tax on groceries and temporarily suspending the state’s 18.4-cents-per-gallon gasoline tax. The Senate also proposes one-time tax rebates of $100 to $1,000.

“During the many hours we have spent with the House on this issue, we have not said we do not support ever eliminating the income tax in Mississippi,” Hosemann said in a statement Wednesday. “We can address further cuts at any time. Taxpayers expect us to be responsible stewards of tax dollars. The Senate’s plan includes cutting taxes and taking care of core government services — not gutting them.”

Saturday is the deadline for the House and Senate to reach deals on tax and spending bills for the budget year that begins July 1.

Mississippi has enjoyed robust tax collections the past several months, partly because of increased federal spending during the COVID-19 pandemic. But the state also faces expensive budget items, including a long-running court case that requires improvements to the mental health system. Legislators have rarely put all the required money into a school funding formula that has been in law since the late 1990s.

Mississippi’s income tax generates 34% of state revenue, and the poorest residents would see no gain from eliminating the income tax because they are not paying it now.

Gunn said Wednesday he’s willing to have the Legislature spend about half of the $1.9 billion of the pandemic relief money Mississippi is receiving from the federal government. That’s a change from Gunn’s position in recent weeks, when he had said he would oppose spending pandemic money until the Legislature agrees to phase out the state income tax.

Gunn said the House would propose spending the federal money on projects such as broadband expansion and water and sewer system improvements. Senators started passing bills several weeks ago to spend the state’s pandemic relief money. The Senate wants to spend $750 million of it it for water and sewer projects. Both chambers must agree on a plan.

At the Capitol on Wednesday, several religious leaders called on legislators to spend pandemic relief money to improve people’s quality of life. The Rev. Jason Coker said students at an elementary school in the Delta town of Shaw were unable to wash their hands on campus for several months because of water quality problems.

“We live in the United States of America, and we’re here pleading for our state for water and sewage,” Coker said.