Lincoln County supervisors opt for low deductible, higher premium in insurance renewal

Published 9:26 pm Monday, March 26, 2018

Monthly insurance premiums for county employees will increase by nearly one-fifth after supervisors on Monday chose to sacrifice payments, but keep a low deductible.

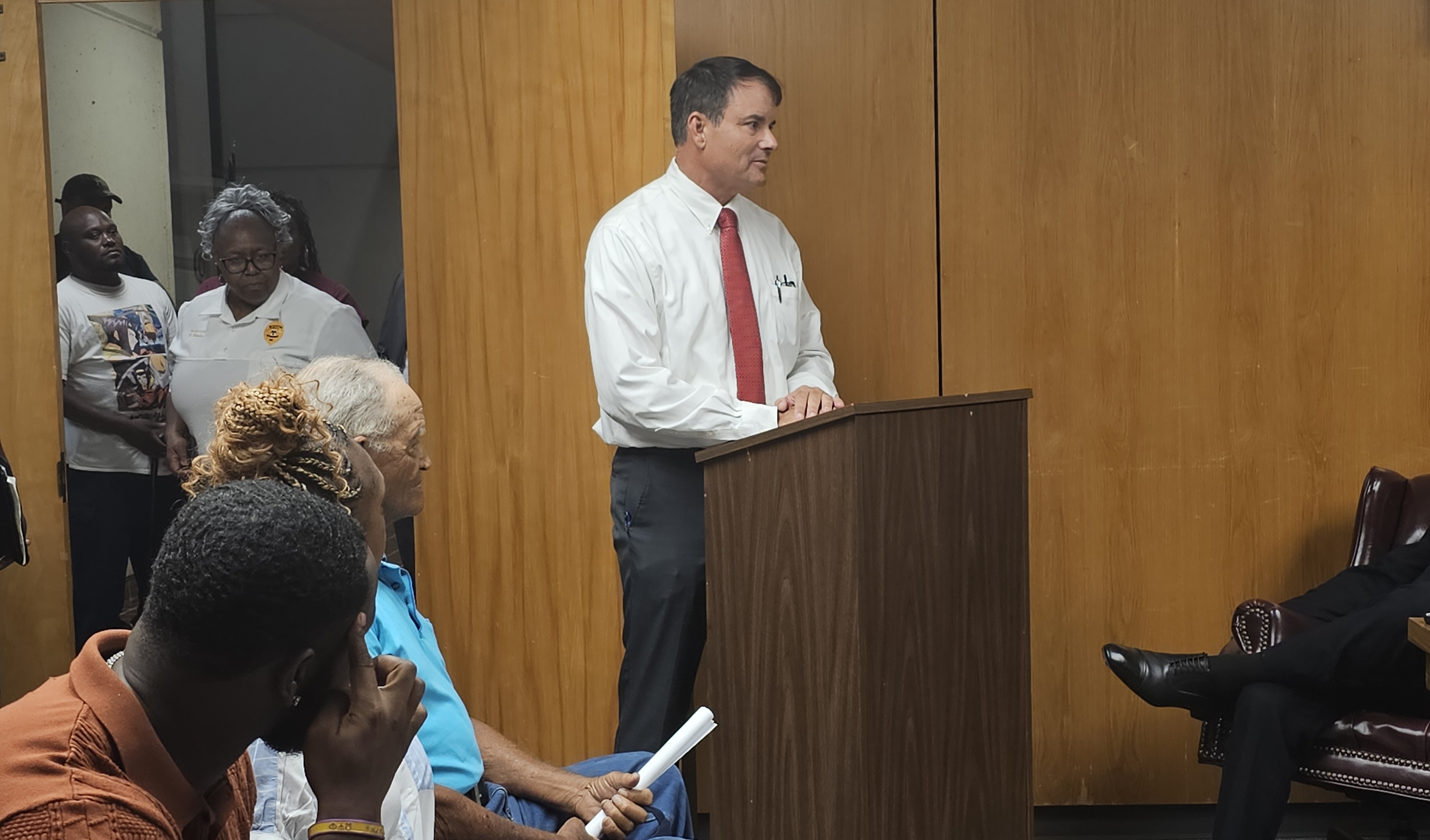

Faced with a set of limited options for insurance renewal, supervisors decided maintaining a $1,000 deductible at the expense of a 17.5 percent increase in monthly premiums would affect the fewest of the 138 county employees who receive insurance through their jobs. District 4 Supervisor Eddie Brown made the motion, with District 3 Supervisor Nolan Earl Williamson providing the second.

“Employees can’t go above $1,000 on their deductibles,” Brown said.

The board approved the resolution 4-1, with District 5 Supervisor Doug Falvey opposed. Falvey was in favor of doubling deductibles to $2,000, which would have capped the premium increases at a lower rate.

“The only person who would be punished would be the person who uses the medical plan,” Falvey argued.

County employees open enrollment will begin April 1, with the new coverage taking effect May 1.

Under the new plan, the 21 employees enrolled in family coverage will take on an increase of $210 per month (for a total monthly premium of $2,152.85); the 28 who ensure their spouses would see an increase of $121.63 ($1,558.97); the 17 with children insured would pay an additional $96.98 ($1,373.37); and the 72 employee-only enrollees’ rate increase of $110.57 would be negated by county contributions.

The coverage will see deductibles of $1,000 with 100 percent coverage (not including co-pays) and a $4,000 maximum out-of-pocket, including the deductible. Dental, vision and life insurance will remain as part of the plan.

Supervisors were faced with increases after current provider UnitedHealthcare was the only insurance provider to submit a proposal to cover the county. Insurance agent Sylvia King said other providers declined to make offers to Lincoln County due to the bad health of the current employee pool.

“They didn’t want us,” she said.

King said the group contains two employees who have gone beyond $200,000 in medical expenses, with numerous others surpassing the $100,000 mark with monthly prescription drug expenses exceeding $30,000. Several employees suffer from a mix of rare and costly ailments, like brain conditions, aneurisms, cystic fibrosis and other sicknesses. Additionally, the average age of the group is 50.

“We have a very unhealthy plan with a lot of health conditions going on,” King told supervisors last week. “We’re in a situation where (the providers) just can’t do it. They’re losing money on us.”