LCSD: No tax increase in $28.8M budget

Published 10:30 am Tuesday, June 16, 2015

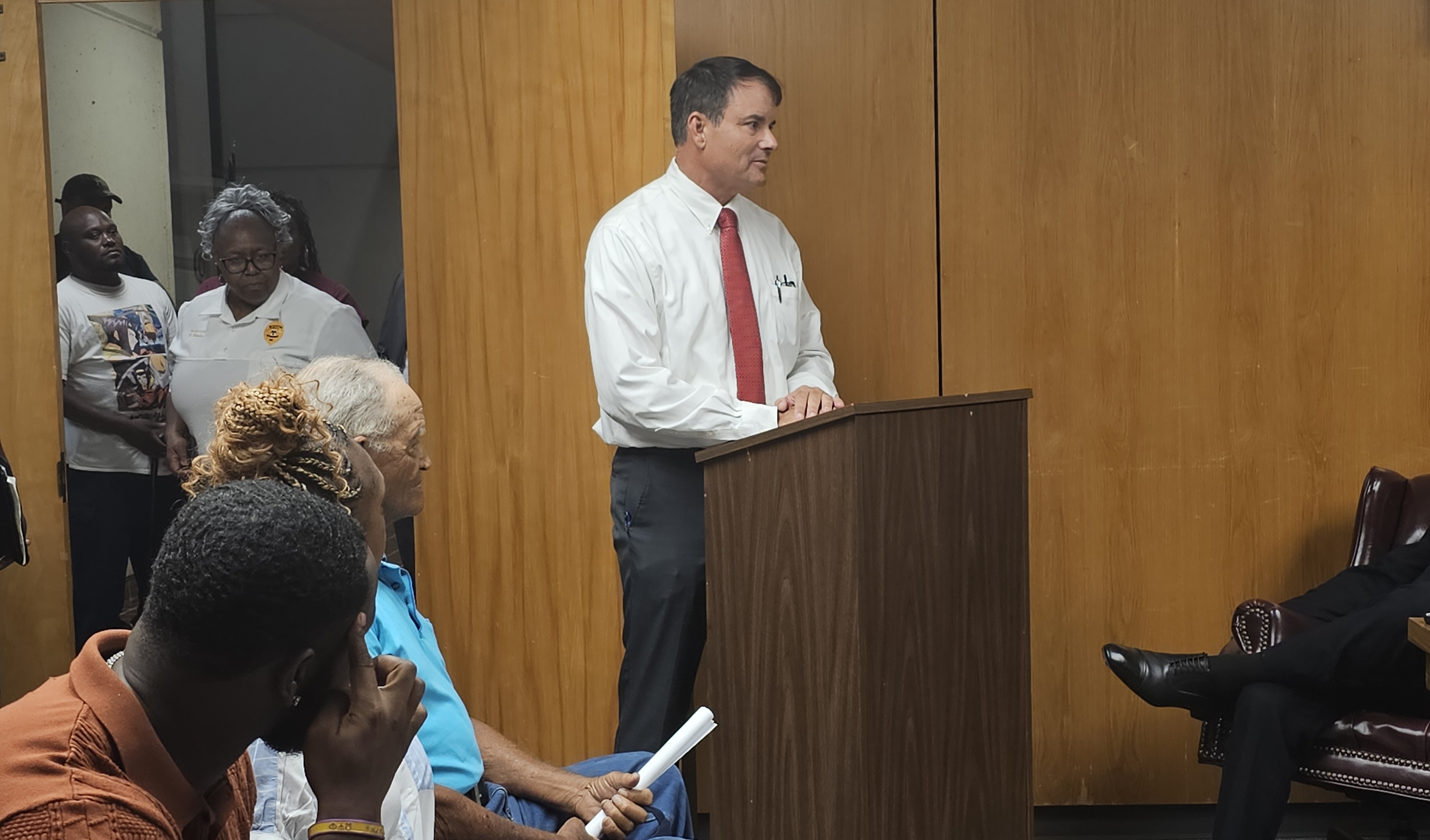

The Lincoln County School District is expecting $797,000 more in state funding for the upcoming school year — $255,000 of that will go toward a mandated teacher pay raise. The district’s $28.8 million budget proposal, which doesn’t anticipate a tax increase, was presented at a public hearing Monday afternoon.

Cheryl Shelby, LCSD business manager, said another $111,000 of the state’s funding increase will go to schools to make funding more even. She looked at each of the four schools to see what was spent per pupil. She took the highest and made the other three equal to that amount.

“Now, whether they live in Ricky’s district or Jack’s they’re receiving the same dollar amount spent on their kid,” she said.

In the new budget, district spending per pupil is $6,378.

The remaining state funds will allow the county to reduce expected transfers from other funds, such as savings accounts.

In the 2015-2016 budget, the highest expenditure is expected to be salaries and benefits. At $16,501,178, that makes up 84 percent.

“That’s pretty common in all public school districts,” Shelby said.

Expected revenue for the new budget year is $25.7 million. Budgeted expenditures total $28.8 million. The district is expected to have a $29.4 million fund balance at the beginning of the fiscal year.

“We wouldn’t [budget higher than revenue] if we didn’t have a healthy fund balance,” she said.

One reason for the higher spending than projected revenue is the district has several construction projects ongoing. Instead of borrowing the money, the district has saved up the money beforehand.

Shelby said in her 15 years with the district, they have never spent all that was budgeted.

The district’s local budget request is the same as was received last year.

“We don’t set mills,” she said. “We request a dollar amount, and the county sets the millage rate.”

For this past school year, the millage rate, which is used to calculate ad valorem taxes, was set at 52.84. It was an increase over the 2013-2014 school year when the millage rate was 48.78.

The district received more money than requested and put the extra dollars in escrow to reduce the money requested in 2014, which is why there was a drop in the district’s millage rate. Last year, the district’s request returned to an amount similar to 2013.

However, Shelby pointed out that the current millage rate is still lower than it was 10 years ago during the 2005-2006 school year when it sat at 54.15.

Shelby also pointed out that even if mils do not increase, property taxes can still increase if property values increase.

For the upcoming year, the district requested $4,158,638 in ad valorem taxes for operations. That number is based off the amount of ad valorem taxes collected from October to May ($3,301,991) and the expected collections from June through September ($656,792). The expected collections are based off of 2014’s numbers.

Shelby said by law the district could increase their amount request by 4 percent ($166,346) plus $130,391 for special programs. Shelby said they have not done so in several years because the school board recognizes the hardship that puts on the county residents. The district doesn’t have businesses to benefit from and instead must rely on individual property owners.

Local revenues make up about 16 percent of the district’s projected income, with state dollars making up the bulk of the revenue.

The budget will be voted on at a special board meeting to be held on June 29 at 5 p.m.

In other district business, the board approved Insurance & Risk Manager’s policy for property insurance for the 2015-2016 school year. This year’s policy is approximately $90,000 less than last year’s.

Shelby said Dennis Valentine at Insurance & Risk Manager’s said the policy will likely return to the previous amount next year. Because of this, Shelby said they will use the extra money for a one-time expense, such as the purchase of a new bus. Buses usually cost around $75,000.