Budget offers mixed bag for some residents

Published 5:00 am Friday, September 15, 2006

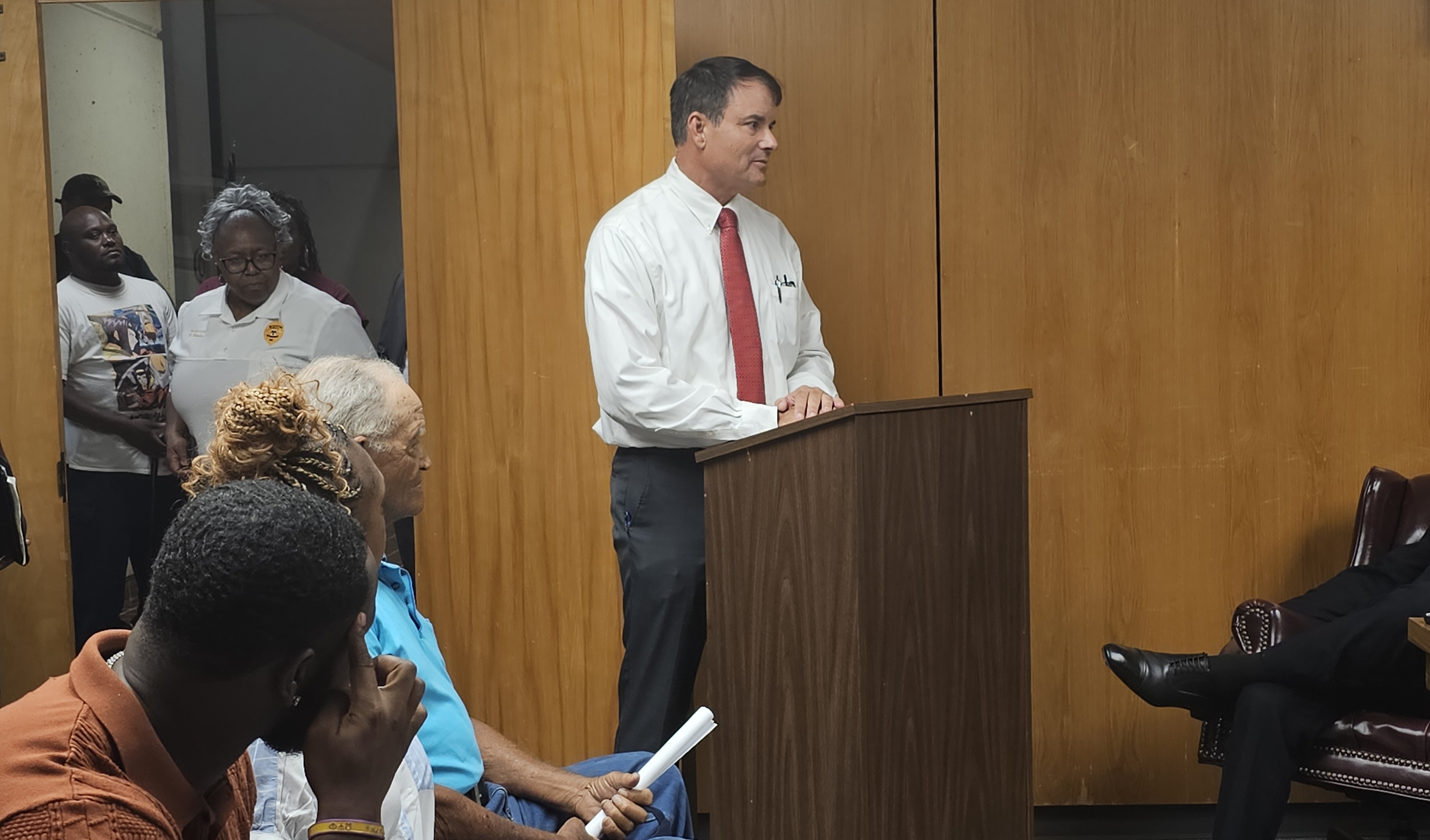

Lincoln County supervisors have approved a $16.8 million budgetthat calls for no increase in the overall property tax levy, but itappears likely that city school district residents could be payingmore to help support county operations.

The budget for the new year, which starts Oct. 1, calls for$12.59 million for county operations and funds a $3.60 millionrequest for Lincoln County School District support. The countyoperations portion of the budget is up $361,850, or 2.9 percent,from the current year while the school portion is down $79,261, or2.15 percent, according to a budget summary.

“The department heads did a great job on this budget and I thinkwe did OK with it,” said District Five Supervisor Gary Walker, whois president of the board.

On the revenue side, officials are expecting about $643,000 morein county property tax funds, an increase of about 5 percent fromthe current year.

“We got more money from changes in assessed valuations,” saidCounty Administrator David Fields.

While the overall property tax levy is forecast to remain thesame at 95.37 mills, there are fluctuations in the respectivelevies for county school and county operations. The levy for countyschool operations dropped from 55.48 mills to 51.93 mills, but thelevy to support county operations increased from 39.89 mills to43.44 mills.

One mill is equal to one dollar for every $1,000 of assessedvalue of a person’s property.

For residents of the Lincoln County School District, the neteffect of the county budget action is that they should not bepaying more in taxes unless there was an increase in the assessedvalue of their property.

City residents and those outside the city who live within theBrookhaven School District boundaries, however, will see theeffects of the higher tax levy for county operations and will notsee the benefit of the decrease in the county school district taxlevy. For them, the budget action indicates they will be paying tothe county about $3.50 more for every $1,000 of assessed propertyvalue.

All property owners pay Lincoln County taxes, but they pay onlyone school tax and that depends on the school district in whichthey live. Brookhaven residents also pay property taxes to supportcity services and operations.

County officials acknowledged the probability of higher countyproperty taxes for residents in and around the city limits.However, they pointed out a general fund spending increase that wasrelated to action by city leaders earlier this year.

Of a $245,356 increase in general fund spending, Fields said$147,000 will go to to support the Lincoln County Multi-UseFacility. Due to time and personnel constraints, city recreationleaders voted to give up day-to-day oversight of the facility andcommunity leaders agreed on a plan for the county to operateit.

“The other things are fuel costs and utility costs,” Fields saidabout additional spending increases.

Fields also cited payroll increases for employees.

“Most departments got 2 percent to work with on the raises,”Fields said.

Fields said there was no increase in the jail budget, which wasfinishing up the current year under budget. He did not speculate onthe impact of the pending return of state inmates to the countyjail.

“It’ll depend on how many we get back here,” Fields said. “We’llhave to wait and see.”

Walker indicated there was little change in the budget over thetwo-year period.

“All of it is pretty much the same as last year,” Walkersaid.

In other spending decisions, supervisors increased funding forthe Lincoln County Library from three-quarters of a mill to a fullmill, an increase of about $49,000; rejected a one-mill increasefor Copiah-Lincoln Community College support; and implemented a.68-mill plan to pay a bond issue for the new LinBrook BusinessPark.

On the county school side, Fields pointed out a decision bydistrict trustees to no longer participate in a Vo-Tech programwith the city. School officials cited low program enrollment thatdid not justify the district’s financial investment.

“If they hadn’t gotten out of that, we probably would have hadto raise millage,” Fields said.