Bill would cut farm taxes, shift to other taxpayers feared

Published 9:02 pm Tuesday, March 26, 2019

(AP) — A bill nearing passage in the Mississippi Legislature could cut property taxes for owners of farmland and timberland, but leave owners of homes, cars and commercial property paying higher tax rates.

House Bill 1456 would alter a formula setting the taxable value of agricultural land to mandate a 16.67 percent decrease in value that would take place over five years. Farmland and timberland isn’t taxed on market value, but on a legal formula computing its economic value.

The measure is pushed by the Mississippi Property Tax Alliance, a group of farmers in Leflore and Holmes counties who say taxes are too high.

Harry O’Neal, one of the group’s directors, said agricultural land values have risen following good crop years, increasing land taxes that farmers pay.

“Our taxes are so much higher than our surrounding states and it’s beginning to affect our commerce and agriculture,” O’Neal said during a visit to Capitol earlier this month to lobby for the bill.

O’Neal showed a tax bill where he’s paying $2,438 for 44 acres, or $55 an acre. But another alliance director, David Grossman, paid an average of $15 an acre on 1,500 acres in Leflore County that have no buildings, according to tax records. Even at lower values, large farmers can face substantial tax bills. Tackett Fish Farms paid more than $230,000 last year in taxes in Leflore County last year on land and building valued at $13.8 million. The same family founded the Heartland Catfish processing plant in Itta Bena.

Others say farmers and timber owners already get a break on taxes because of the formula Mississippi uses to set tax values. Leflore County Tax Assessor Leroy Ware said the formula values land in his county at $900 to $1,500 an acre when in reality it sells at $3,000 to $4,000 an acre. Some farmland for sale in the county is listed online at $5,000 an acre.

“They’re already getting a substantial reduction,” Ware said.

State Revenue Commissioner Herb Frierson said his department doesn’t have a position on the bill. He said the overall statewide impact is likely to be small, focused only on some agricultural lands with particular soil types.

Some county officials in the Mississippi Delta are speaking out against the plan.

“The tax burden will shift to business and home owners (many of who are retired) through real estate and motor vehicle tax,” states a flyer from Bolivar County supervisors, obtained by The Greenwood Commonwealth.

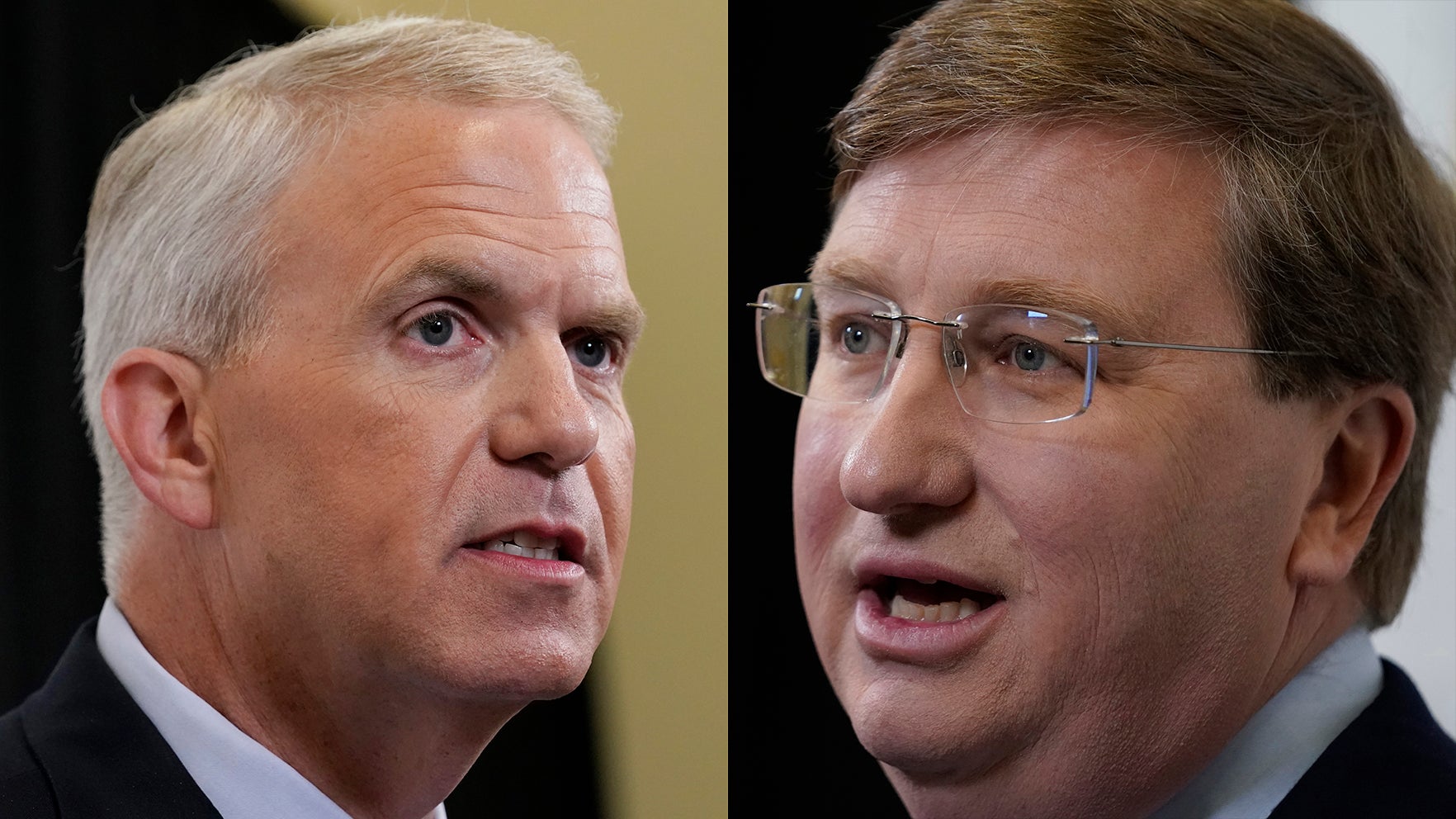

Senate Finance Committee Chairman Joey Fillingane, a Sumrall Republican, cited concerns about a tax shift in explaining why the bill was sent to a House-Senate conference committee.

“This may be great for our farmers, but what effect would it have on our other property owners?” Fillingane asked.

Leflore County government collected about $15 million a year in property taxes, and Ware said farmland and woodland makes up about 18 percent of the county’s tax base. If nothing else changed, farmland would fall to about 15 percent of the county’s tax base after the bill took effect.

Any overall decrease might be offset by rising property values, but officials could feel pressure to raise tax rates. Mississippi school systems request set amounts of tax money from county and city boards, which are then translated into a tax rate. If values decrease, tax rates will rise. Plus, city and county governments face pressure from rising pension, health insurance and construction costs.

If House Bill 1456 passes, it would be the second major success for the Mississippi Property Tax Alliance. In 2017, lawmakers agreed to a 4 percent cap on how much property taxes can change in Mississippi, holding down tax increases. The alliance’s success shows even a small lobbying group can succeed in Mississippi, especially with a Republican-controlled government that has granted hundreds of millions of dollars in tax breaks over the past eight years. The alliance doesn’t have a registered lobbyist this year, and Jim Tackett is the only director with a history of more than minimal campaign contributions.

Milton Parrish, another director, said the group is aiming for additional tax cuts in the future.

“Our goal is if we could get a cap on land taxes to where it would not exceed 1 percent of the value of the land or 1 percent of the rental value of the land,” he said.